This week there are separate assignments for 2305 and 2306.

For GOVT 2305:

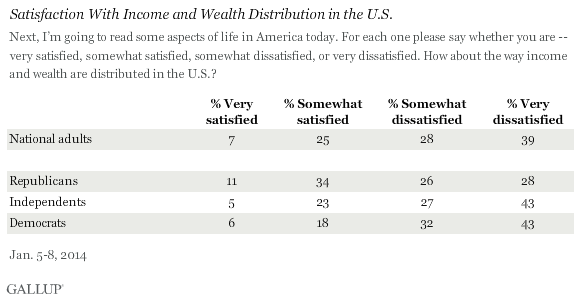

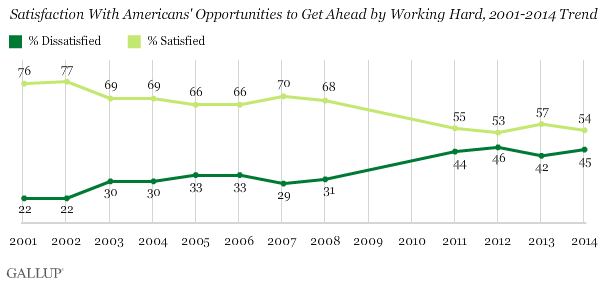

On Tuesday President Obama is scheduled to give his state of the union speech and all indications suggest that he will focus on inequality - which has been a focus of some of our class discussions and recent posts. I mentioned that Republicans have joined Democrats and Independents in seeing this as a problems that deserves to be on the public agenda.

But there are certain to be major differences in the conservative and liberal approach to the problem - as well as different positions on how serious the problem is.

Since we've spent a little time looking at the ideology and the role it plays in clarifying people

s positions on public issues, I want you to apply this to issue of inequality. What is the liberal approach to solving inequality? What is the conservative approach? Here is a related question: What do liberals and conservatives see as the underlying cause of inequality? Knowing this will help understand why each takes the positions on policy formation on the issue.

Also: How much does each group think the problem has a solution that government can implement successfully?

150 words minimum

For GOVT 2306:

We've spent a good but of time unpacking the tension that exists between the government of Texas and the government of the United States and have emphasized areas where this tension is acute. A very topical one is over environmental protection. The state government tends to discount its need, while the national government highlights it - at least rhetorically.

I'm a post a bit further below I pointed out how the state is attempting to push back against federal regulators and the EPA specifically - though other federal regulators are active in regulating Texas industry as well.

Maybe the best way to get a handle of dispute is to fully understand the constitutional disputes that underlie this conflict. In this assignment I want you to get familiar with the conflict over regulating the chemical industry in Texas - in order to protect the environment - and highlight how this can come down to conflict over different aspects of the constitution.

What are the constitutional roots of the conflict over environmental protection policy in the United States? How does this help explain the conflict between the US and Texas over environmentalism?

150 words minimum