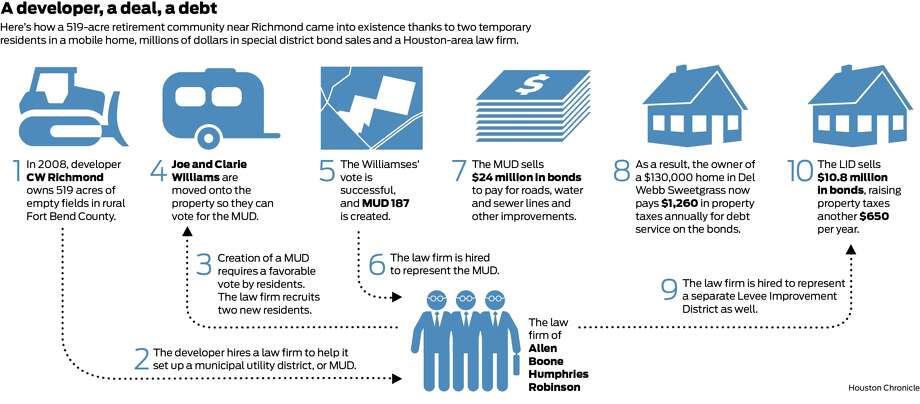

MUDs are among the smallest of the special districts, and are primarily a device used by developers to fund infrastructure, like "water and sewage systems, drainage, parks, recreational facilities, roads and fire stations." The Chronicle reports that their numbers are increasing, which increases the amount of debt held in the state - a state like likes to brag about not having any. Multiple other complaints about them exist as well, as this story lays out.

- Click here for the article.

- Click here for the article.

Across bright-red Texas, where many politicians tout small government and low taxes, MUDs and other so-called special purpose districts are proliferating - and selling bonds - at a rate many experts inside and outside government find increasingly problematic. They cite high indebtedness, insufficient state oversight, cozy relationships with developers, a lack of responsiveness to citizens and potential conflicts of interest. MUDs can be created either by the Texas Commission on Environmental Quality or the Legislature.

Their spread throughout the prairies that once surrounded Houston and other municipalities has helped fuel "growing unrest" about the property tax burden in Texas, said John Kennedy, senior analyst for the Texas Taxpayers and Research Association, a nonprofit group based in Austin. Many taxpayers like Gay find it hard to track all the property tax bills they receive from counties, school districts, MUDs and other special purpose districts, Kennedy said.

"Those special purpose districts sort of operate in kind of a semi-netherworld out there," he added.

There are 1,751 active water districts in Texas, a class of special purpose districts tracked by TCEQ, ranging from large river authorities to tiny irrigation districts, including 949 MUDs, according to the state.

The epicenter of water district financing: Houston's suburbs.

Forty-four percent of those 1,751 districts are in Harris, Fort Bend and Montgomery counties. Sixty-five percent of the 949 MUDs are in those three counties - 389 in Harris County, 146 in Fort Bend County and 85 in Montgomery County.

MUDs are the most popular type of water district in Texas with developers, in large part because they hold enormous sway over how they're created and because MUDs are empowered to issue tax-exempt bonds covering the developers' infrastructure costs.

Taxpayers' advocates increasingly view them as a problematic way to pay for infrastructure in the face of climbing local government debt, given their sweeping power to sell bonds and raise taxes.